7:35 PM How Your Gender Can Affect Your Auto Insurance Premiums | ||||

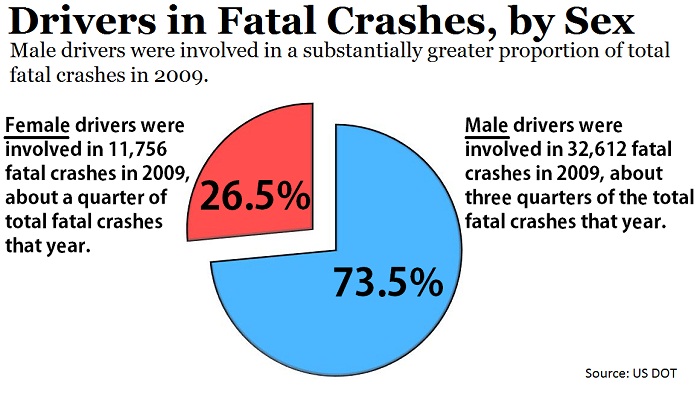

#automobile insurance rates # How Gender Can Affect Car Insurance RatesBehavior which is commonly attributed to a certain gender, that is whether you are male or female, can indeed affect car insurance rates. Insurance companies look at national statistics regarding accident rates and the age and sex of the driver who is cited for being the one who caused the accident. These statistics show a significant increase in the amount of accidents initiated by males between the ages of 16 and 30 over women of the same age group. So if you are a male driver who happens to fall in this age group, you will probably have to pay a higher auto insurance premium than your female counterpart. Another factor influencing a car insurance agency’s propensity to charge a young male more for their car insurance is the fact that they also tend to drive more than girls. In addition, they are more apt to take risks while driving and especially drive cars deemed “sports” vehicles which are driven at a higher rate of speed. Thus, the incidence of speeding ticket issuance rises dramatically in young males, also. Male Drivers and StatisticsYou might be thinking that this is a good example of some sort of stereotyping, right? Well, it isn’t really, since the automobile insurance companies have the statistics to back up their claim that young male drivers cost them more money than young females or older drivers of either sex. However, there are ways in which you, as a young male driver, can help reduce your monthly insurance premiums and prevent most of your paycheck from being consumed by auto insurance. Other risk factors are examined by agencies when they quote someone a rate and some of these can be properly managed which can contribute to lower payments. These risk factors are:

When a male driver turns 25 years old, most car insurance agencies will lower their rates as long as they have a clean driving record—clean meaning no serious accidents and no more than one speeding ticket or other traffic violation ticket for at least three or four years in a row. Also, if a 23 year old male happens to get married, his insurance rates will also be reduced, although the amount of this reduction varies among the many different auto insurance companies.

How to Lower Car Insurance Rates Despite Your AgeIf you are an unmarried male under 25 and find yourself paying a hefty car insurance premium, there may be some things you can do to reduce this amount, depending on the policies of your agency. Some insurers have programs which drivers can choose to take that help them learn “defensive” rather than “offensive” driving habits. An “offensive” driver is one who tends to drive too fast, feels the need to be ahead of everyone by weaving in and out of traffic in a reckless manner and becomes unreasonable angry at other drivers who “don’t know how to drive”. These kinds of drivers are the ones who will be involved in more accidents than the safer, “defensive” driver will be. Unfortunately, a lot of aggressive driving is done by young males and insurance agencies are well aware of this. Because of this, they will offer a course on how to drive safely to inexperienced drivers, along with a discount on these drivers’ rates if they successfully complete the program. Another way to lower your rates is to think twice before you install that modification on your car with the expressed intention of giving it more power, such as replacing the manufacturer’s wheels with something big and sporty or swapping that boring old engine for an engine that came out of a faster car. If you modify your car this way but do not inform the insurance company about it and have an accident which is your fault, they may consider these modifications as a liability and refuse to reinstate your policy. More about Lowering RatesSomeone who uses their vehicle just for daily errands around town is obviously less likely to be involved in an accident than someone who has a long drive to work, takes frequent weekend trips, and simply drives more in general. Insurance companies will want to know how many miles you put on your car in a year and charge you accordingly. As a younger male trying to keep your insurance payment as low as possible, you might want to think about carpooling or taking the bus if you have a long commute to work every day. The main thing to remember if you are a young male driver is to drive without a lead foot and avoid being reckless. You will be rewarded for being a sensible driver after you turn 25 with a reduced insurance payment that will be extra cash in your pocket. Related Articles:

| ||||

|

| ||||

| Total comments: 0 | |